Features of Indiabulls Capital

- Home

- Features

.png)

Insurance Services & Criteria.

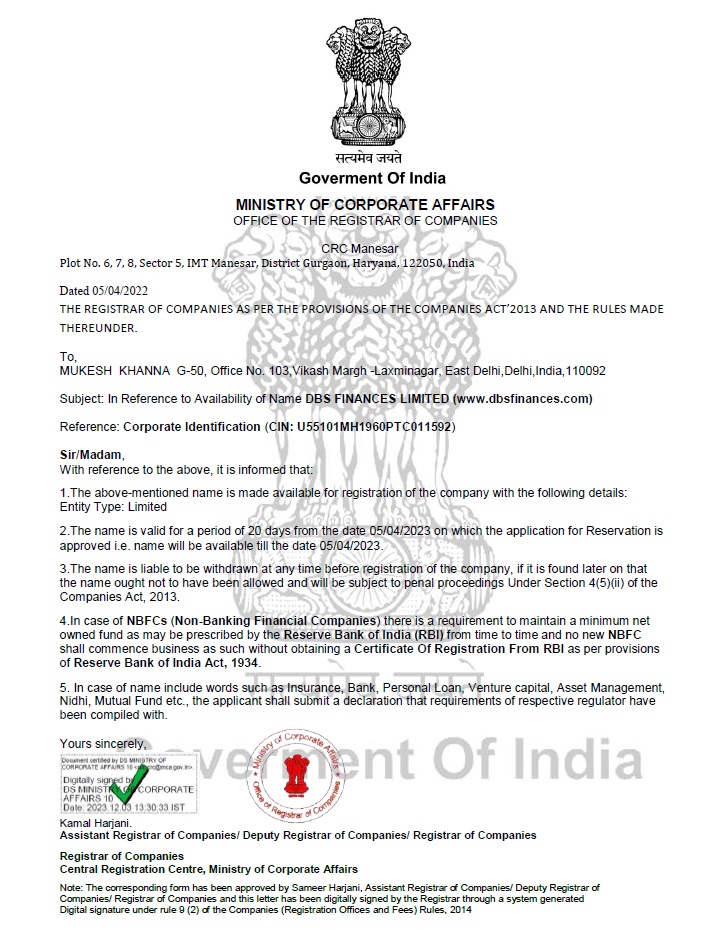

" Loan Protection Insurance " " GOVERNMENT SCHEME "

Credit Guarantee Scheme (CGS) Plan helps you ensure that your family has the best of everything. With this Security, in case of an unfortunate event with the Borrower, your family won't have the liabilities to repay the outstanding loan EMI to the bank. This Loan Protection security Insurance build up your loan guarantor in case of Cibil defaulter account for Instant loan

Death Benefit: The Death Cover would be the Outstanding Loan Balance at the Time Death as per the amortization schedule in your certificate of insurance.