Benefits of Indiabulls Capital

- Home

- Benefits

Benefits Of Loans

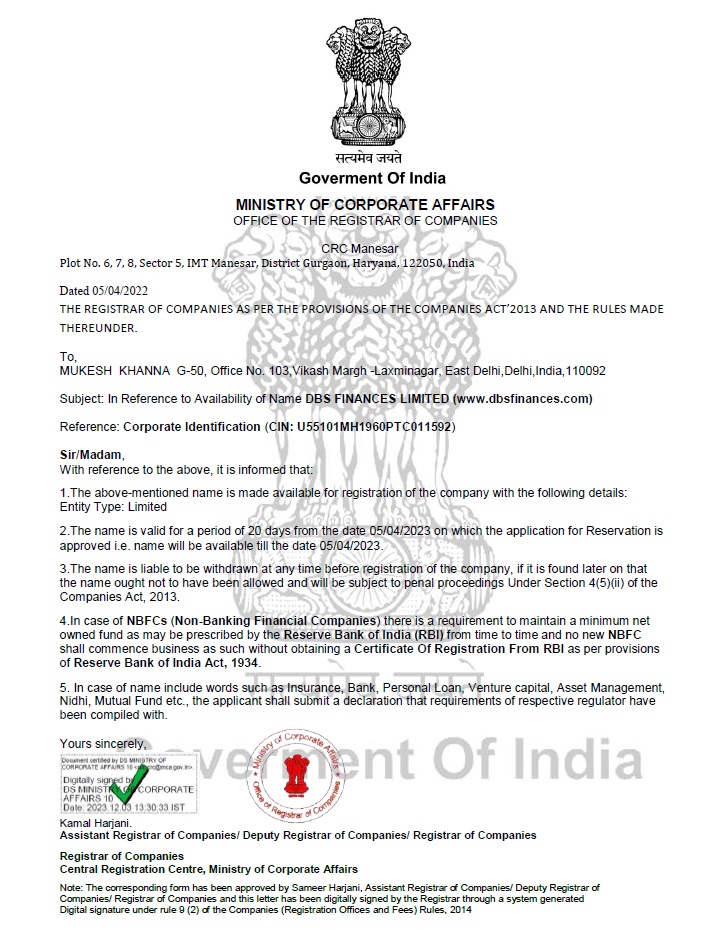

Our Loan-Related Documentation will be requested by the appropriate team after you enrol in Indiabulls Capital. All of your paperwork are then compiled into a file, which we submit to several collaborating NBFC Banks. Your profile is reviewed by NBFC banks, who compare it to the needed profile and approve the loan. If your profile is compatible with more than one NBFC Bank, Indiabulls Capital will provide you a list of those that will approve your loan, saving you the time and effort of visiting many banks.

Flexible loan tenures

Flexible tenures and easy repayment options and competitive interest rates.

Get money in 24 hours

Minimal documentation with instant approval.

No collateral required

You don't have to pledge your assets as a collateral to get approved.

.png)

Complete Online

Quick and hassle-free online processing. Get finance from the comfort of your home.

.png)

Insurance Services & Criteria.

" Loan Protection Insurance " " GOVERNMENT SCHEME "

Credit Guarantee Scheme (CGS) Plan helps you ensure that your family has the best of everything. With this Security, in case of an unfortunate event with the Borrower, your family won't have the liabilities to repay the outstanding loan EMI to the bank. This Loan Protection security Insurance build up your loan guarantor in case of Cibil defaulter account for Instant loan

Death Benefit: The Death Cover would be the Outstanding Loan Balance at the Time Death as per the amortization schedule in your certificate of insurance.